SECURE Act 2.0 – Tax Incentives & More

In an effort to help Americans build a better nest egg for their future and to help create a more robust retirement system, congress passed SECURE 2.0, building on the original Secure Act from 2019. The policy includes many provisions that may positively impact many Americans – including small business owners (and contractors), boosting future financial confidence. The SECURE Act 2.0 makes it easier for small businesses to offer retirement plans to their employees by eliminating some of the red tape and paperwork associated with starting a plan. It also provides tax incentives for businesses that do start retirement plans. Here are some of the highlights!

Secure Act 2.0 Employer Start-Up Credit

With this tax credit, business owners can offset the cost of starting a qualified retirement plan (such as a prevailing wage 401(k) plan), which can be a useful tool to attract and retain employees.

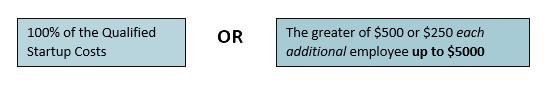

Assuming all other IRS requirements are met for employers who have no more than 50 employees1, the maximum credit is 100% of qualified start-up costs, up to $5,000. (For employers with 51 – 100 employees, the existing 50% credit remains unchanged.)

Credit Formula

Contribution Credit

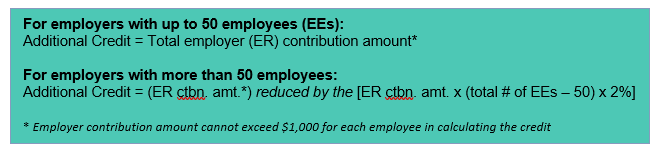

The start-up credit described above is increased for small employers that make contributions to their employees, which includes prevailing wage contributions! The credit is not available for employees earning over $100,00 in FICA wages for the year and is capped at $1,000 per employee.

Employers can receive a credit of 100% of eligible contributions for the first and second years of the plan. The credit is reduced years three through five. The full credit is available to employers with 50 or fewer employees and is phased out for employers with 51 to100 employees.

Credit Formulas (employers with up to 50 employees and for those over 50 employees)

Example

Assume that ABC Construction has 20 employees, all employees make less than $100,000, and ABC Construction contributes $2,000 in fringe dollars to their 401(k) plan for each employee.

To determine the contribution credit, ABC Construction will multiply the 20 employees by the $1,000 maximum credit for a total of $20,000. This means that the contribution tax credit for ABC Construction will be $20,000 in year one!

Assuming that the number of employees stays the same, the credit would be the same for the second year of the plan. The credit would be reduced in years three through five, and then would be eliminated in year six.

Some other SECURE Act 2.0 provisions of note:

- Part-time employees will be eligible to enroll in their employer’s retirement plan after two years instead of three. *Current law explains that a “long-term, part-time” employee is anyone who has worked at least 500 hours over three consecutive years.2

- Emergency Savings – this provision provides a safety net in the form of an additional savings account3 that employees can access without incurring any taxes or penalties in the case there are unexpected expenses, such as a job loss, medical emergency, or natural disaster.

- Catch-up contribution limits for those 60-63 – in 2025, this age group will be able to sock away even more money.4

The SECURE Act 2.0 is a big win, particularly for small businesses and contractors who want to offer retirement benefits to their employees but were put off by the costs and hassle of starting a traditional retirement plan. Plus, for anyone who has a 401(k) or IRA, the act’s increase in the age at which distributions must begin will give retirement accounts an extra two years to grow before having to tap into it.

Have more questions about SECURE 2.0? Feel free to contact the Beneco team or get with your trusted financial advisor to learn more.

All information and content provided are for general information purposed only. The information provided does not, and is not intended to, constitute legal, tax, accounting, or investment advice. The content reflects known information as of the publication date, February 2023, and may not reflect the most up-to-date information on this topic; nor is it represented to be error-free. Please consult with a qualified legal, tax, accounting, or investment agent for guidance on your specific issues or questions.