What to Know About State-Mandated Retirement Plans

Has your state issued a mandate requiring you to offer a retirement plan for your employees? The landscape of retirement savings is shifting, and many states are now requiring businesses to provide a way for their workers to save for the future. As a contractor, navigating these new rules is another complex task on your plate.

Whether you’re facing an upcoming deadline or have already enrolled in a state-sponsored plan, it’s crucial to understand your options. You are not limited to the state’s default program. You can choose any qualifying employer-sponsored retirement plan, such as a 401(k), which may offer greater flexibility and benefits for your construction business.

This post will walk you through the key aspects of these state mandates, compare them to a company-sponsored 401(k), and help you make the best decision for your company and your valued workers.

The Rise of State-Mandated Retirement Plans

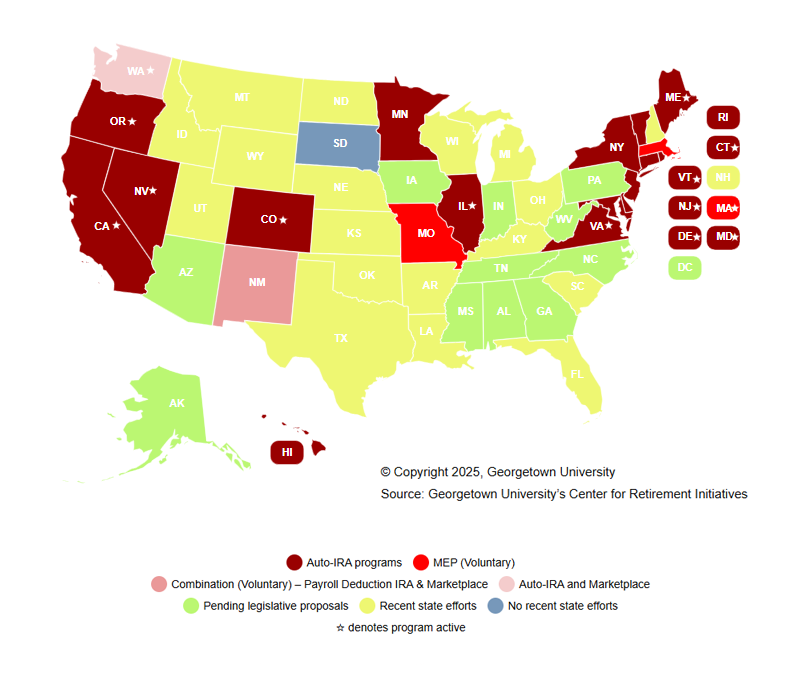

To address a growing retirement savings gap, states across the country have begun implementing their own programs. As of October 2025, 20 states have enacted legislation to create new retirement savings programs for private-sector workers. Of these, 17 are auto-IRA programs, meaning employees are automatically enrolled unless they choose to opt out.

These programs are designed to increase access to retirement savings, particularly for employees of small to medium-sized businesses. While the intention is positive, these “one-size-fits-all” plans may not be the most effective solution for every employer, especially those in the construction industry.

Penalties for Non-Compliance

It is important to understand that states are enforcing these mandates with financial penalties. Missing an enrollment deadline or failing to comply with program requirements can lead to significant fines that vary by state.

For example:

- California: Employers face a fine of $250 per eligible employee for initial non-compliance. If the failure to comply continues, that penalty increases to $500 per employee.

- Connecticut: The state has a graduated penalty structure. Fines range from $500 for small employers to as high as $1,500 for larger companies for each year of non-compliance.

These penalties underscore the importance of taking action. Whether you choose the state’s plan or find a better alternative, you must have a qualifying plan in place to avoid these costs.

State-Mandated Retirement Plans vs. a 401(k): Key Differences

While state-mandated plans provide a basic savings vehicle, they often lack the robust features and flexibility of a traditional 401(k) plan. Most state plans are set up as Roth Individual Retirement Accounts (IRAs), which have some fundamental differences compared to a 401(k).

Contribution Limits

One of the most significant differences is the amount you and your employees can save. 401(k) plans allow for much higher annual contributions. In 2025, an employee can contribute up to $23,500 to a 401(k), with additional catch-up contributions for those over 50. In contrast, the IRA contribution limit for 2025 is just $7,000. This substantial difference can impact your team’s ability to build a secure retirement.

Flexibility and Customization

A 401(k) plan is your company’s plan. You can tailor it to meet the unique needs of your business and employees. This includes options for:

- Employer Matching: You can choose to match a portion of your employees’ contributions, a powerful tool for attracting and retaining skilled workers.

- Vesting Schedules: You can set up schedules that reward employees for their long-term loyalty to your company.

- Profit Sharing: This feature allows you to make additional contributions to your employees’ accounts during profitable years.

State-run IRAs typically do not allow for employer contributions or the kind of customization that makes a retirement plan a strategic business tool.

Benefits for Prevailing Wage Contractors

For contractors working on prevailing wage projects, a 401(k) offers a distinct and powerful advantage. You can direct the fringe benefit portion of the prevailing wage directly into your employees’ 401(k) accounts. This accomplishes two things:

- It significantly boosts your employees’ retirement savings.

- It can reduce your payroll tax burden and lower your overall labor costs, making your bids more competitive.

This is a specialized benefit that state-mandated IRA plans simply cannot offer.

Why a 401(k) May Be the Better Choice

While a state plan might seem like the easiest path to compliance, it’s often not the most strategic one. By opting for a 401(k), you gain more than just a retirement plan; you gain a tool to build your business.

Benefits for Prevailing Wage Contractors

Navigating state mandates adds another layer of complexity to running your business. But you don’t have to figure it out alone. For nearly 40 years, Beneco has partnered with contractors to create benefit solutions that address their unique challenges and opportunities.

Whether you’re facing an approaching deadline, have missed one, or are seeking a better alternative to a state-run plan, contact Beneco. We specialize in building prevailing wage solutions and benefits plans that work for you and your employees. Let us show you how to maximize your prevailing wage dollars, stay in compliance, and create a prosperous future for your entire team.

You can also read more about the Beneco 401(k) Plan here.

Unsure if your state has a state-mandated plan? Click the map below for Georgetown University’s Center for Retirement Initiatives Interactive Map.